bcgamezerkal1.site Recently Added

Recently Added

Sephora Credit Card Perks

Is the Sephora credit card worth it? I know you get 25% off your first purchase with it; are there any other perks or bonuses cardholders. points per $1 spent at Forever 21 with purchase on your Forever 21 Credit Card. Every points earned receive a $5 reward!2. More Details Rewards Terms &. Shopping at Sephora just got even better. Apply for the Sephora Credit Card now and earn 25% off your first purchase today! Please note these terms & conditions: Rewards not eligible on: Orders placed The Alaska Airlines credit card is issued and administered by Bank of. Once approved, you will earn 4% back on every $1 spent in Sephora U.S. stores (excluding Canada and Sephora departments inside of other retailer stores) or at. Get 25% off your first purchase when you apply for an open a Sephora credit card. Credit cardholders also get twice the points and $5 in rewards for every $ Earn 4% back in Credit Card Rewards. That's $5 in rewards for every $ spent at Sephora. · Earn 2x Beauty Insider Points or 4% back in Beauty Insider Cash per. when you open and use your Sephora Credit Card at Sephora today. PLUS earn 4% back in Credit Card Rewards. In store & online. Learn More. Earn 2x Beauty Insider Points with. Every $1 Spent at Sephorai. That's double the points all the time when using your Sephora Credit Card at Sephora. Is the Sephora credit card worth it? I know you get 25% off your first purchase with it; are there any other perks or bonuses cardholders. points per $1 spent at Forever 21 with purchase on your Forever 21 Credit Card. Every points earned receive a $5 reward!2. More Details Rewards Terms &. Shopping at Sephora just got even better. Apply for the Sephora Credit Card now and earn 25% off your first purchase today! Please note these terms & conditions: Rewards not eligible on: Orders placed The Alaska Airlines credit card is issued and administered by Bank of. Once approved, you will earn 4% back on every $1 spent in Sephora U.S. stores (excluding Canada and Sephora departments inside of other retailer stores) or at. Get 25% off your first purchase when you apply for an open a Sephora credit card. Credit cardholders also get twice the points and $5 in rewards for every $ Earn 4% back in Credit Card Rewards. That's $5 in rewards for every $ spent at Sephora. · Earn 2x Beauty Insider Points or 4% back in Beauty Insider Cash per. when you open and use your Sephora Credit Card at Sephora today. PLUS earn 4% back in Credit Card Rewards. In store & online. Learn More. Earn 2x Beauty Insider Points with. Every $1 Spent at Sephorai. That's double the points all the time when using your Sephora Credit Card at Sephora.

Combine 4% back in Credit Card Rewards2 and 4% back in Beauty Insider Cashi (2X points per $1 spent) using your Sephora Credit Card at Sephora. Not a Cardmember. Sephora does not offer a Visa credit card specifically. they do have a store credit card known as the Sephora Credit Card. perks and. You'll be enrolled when you apply for the The Sephora Credit Card Program. That means access to rewards, gifts, savings, and more! coin. Get Deal. All Sephora Credit Cardmembersearn 8% back per $1 spent at Sephora when you combine Credit Card Rewards and Beauty Insider Cash using your Sephora Credit Card. Exclusive Cardholder Perks ; 2X. Beauty Insider Points for every $1 spent at Sephora. ; 4%. back in Credit Card Rewards on Sephora purchases. ; 1%. back in Credit. Exclusive Cardholder Perks ; 25%. off your first Sephora purchase within 30 days of account opening. ; 4%. back in Credit Card Rewards on Sephora purchases. ; 2X. Want more? You can opt to open a Sephora Visa Signature® credit card, which gets you 1% back in credit card rewards for non-Sephora purchases. In. For Sephora. The rewards expire after 90 days. I can get a better deal using my regular rewards card and have fewer cards open. My regular cards. The best way to get rewards is to sign up for their credit card. Not only do you get all the Beauty Insider perks, including Sephora coupons, but you can also. No annual fee. · Annual fee waived during the first year. · Considers applicants with fair credit. · Cardholders can earn rewards on their purchases. · Sephora Visa. Rewards. 4% back in rewards in stores or online at Sephora and 2X Beauty Insider Points per $1 spent at Sephora · Welcome bonus. 25% off your first purchase when. Use only at Sephora stores or on bcgamezerkal1.site · No annual fee + % APR · Get 25% off your first purchase · Earn 4% back in rewards for every $1 spent · Get. Exclusive Cardholder Perks ; 2X. Beauty Insider Points for every $1 spent at Sephora. ; 4%. back in Credit Card Rewards on Sephora purchases. ; 1%. back in Credit. On the other hand, the Sephora Visa is accepted globally wherever Visa cards are accepted, allowing you to make purchases at any merchant. Pros & Cons of Sephora Credit Card · No annual fee. · Annual fee waived during the first year. · Identity Theft Protection. · Considers applicants with fair credit. To break it down further, Sephora Credit Card earned a score of /5 for Fees, /5 for Rewards, /5 for Cost, and /5 for User Reviews. Info about the. Sign up for a Sephora Credit Card to receive a hefty 25% discount on your next order and various cardholder benefits. Sephora Credit Card perks change. How do you earn Sephora Beauty Insider and/or Kohl's Rewards? Rewards Members earn % when you use a Kohl's Card or 5% any other way you pay for all. Sephora Visa cardholders also receive a $20 reward bonus for a future Sephora purchase if they use the card to make $ of non-Sephora purchases within the. Enroll your card to enjoy 3 months of free Shipt membership, then 9 months of membership at 50% off, with free delivery on orders of $35+*. Get groceries.

100 000 Dollar Pc

Yo, what's going on, guys? This is my Asian Jeff set of tour. Say hi to my YouTube video, grandma. Hi. So we got the. We got the streaming PC right. , DOLLAR *PCPartPicker* PC BUILD! | Most EXPENSIVE PCPartPicker Build Skytech Gaming Nebula Gaming PC Desktop – Intel Core i5 F GHz, NVIDIA RTX , 1TB NVME SSD, 16GB DDR4 RAM , W Gold PSU, 11AC Wi-Fi. We configure your PC for the best balance of performance and bcgamezerkal1.site top-tier gaming without the guesswork or the premium. Coolermaster Gaming PC. Powerful HP® OMEN PC gaming Laptops built to meet the demands of todays gamers. Radium PCs is a Melbourne based Australian prebuilt Gaming PC company delivering Gaming computers Australia wide! Along with Custom PCs and Water Cooled PC. MILLION DOLLAR PC [MDPC] | a gallery of the world's most beautiful computer systems. HP 15Z-DB Laptop w/ AMD A GHZ + 16 GB | No HD / No Battery Asus ROG Strix Scar 16 GJ Intel i9 32GB Ram - No Drives - Parts (Total 34 systems). Mid Range. CLX SET GAMER ESSENTIAL PC Gaming PC. WAS $ save $ $ Starting at $65/mo with Affirm. CLX SET. GAMER ESSENTIAL. Yo, what's going on, guys? This is my Asian Jeff set of tour. Say hi to my YouTube video, grandma. Hi. So we got the. We got the streaming PC right. , DOLLAR *PCPartPicker* PC BUILD! | Most EXPENSIVE PCPartPicker Build Skytech Gaming Nebula Gaming PC Desktop – Intel Core i5 F GHz, NVIDIA RTX , 1TB NVME SSD, 16GB DDR4 RAM , W Gold PSU, 11AC Wi-Fi. We configure your PC for the best balance of performance and bcgamezerkal1.site top-tier gaming without the guesswork or the premium. Coolermaster Gaming PC. Powerful HP® OMEN PC gaming Laptops built to meet the demands of todays gamers. Radium PCs is a Melbourne based Australian prebuilt Gaming PC company delivering Gaming computers Australia wide! Along with Custom PCs and Water Cooled PC. MILLION DOLLAR PC [MDPC] | a gallery of the world's most beautiful computer systems. HP 15Z-DB Laptop w/ AMD A GHZ + 16 GB | No HD / No Battery Asus ROG Strix Scar 16 GJ Intel i9 32GB Ram - No Drives - Parts (Total 34 systems). Mid Range. CLX SET GAMER ESSENTIAL PC Gaming PC. WAS $ save $ $ Starting at $65/mo with Affirm. CLX SET. GAMER ESSENTIAL.

Photo Money Best Quality Money Gift Insert Your Face & Name Hundred or Fifity Dollar Bill Perfect Gift Occasion in 25/50///pcs. Get $30 in PC Optimum™ points and 3 months of FREE delivery and pickup (valued at $) with your first PC Express order of $ or more. Use code CA Browse different options in k budget, buy your gaming pc under k in Pakistan today in your desired budget. Gaming Computers under K Budget. Filter. 49" Odyssey G9 G95C DQHD Hz 1ms(GtG) DisplayHDR Curved Gaming Monitor But for a thousand dollar monitor to die less than 30 DAYS after normal to light. CyberPowerPC - Gamer Xtreme Gaming Desktop - Intel Core iF - 16GB Memory - NVIDIA GeForce RTX 8GB - 1TB SSD - Black. Find Gaming PC Parts List from Kingston Technology, Western Western Digital Blue SA M.2 GB Serial ATA III. Western. Shop CyberPowerPC for Gaming PCs. Customize your dream gaming PC or select a prebuilt gaming computer today DASMEHDI Windows 11 Home AMD Ryzen™ 9 X3D. Everyone should be empowered to get the exact used gaming PC they want in a suitable condition at the right price so their dollars go further. The gaming PC is. Select your budget, pick your games, and see how they perform, then let us build and optimize your gaming PC. After a little more? Why not customize it. OMEN 25L Gaming Desktop GT Up to NVIDIA® GeForce RTX™ graphics. Windows 11 HomeIntel® Core™ i Heat-. RMx Series™ RMx — Watt 80 PLUS® Gold Certified Fully Modular PSU; Windows® 11 Home; Includes Free US Ground Shipping; 2 Year Part Replacement with Buy Shark Cash Cards for PC. Cash is king in this town. Solve your money problem and help get what you want across Los Santos and Blaine County with the. Keep winning. Uninterruptible power designed just for your gaming PC. Shop APC. Replacement Battery. $USDCurrent price: $ Add to cart. CORSAIR W USB-C Travel Adapter. $USDCurrent price: $ Custom built Gaming PCs by iBUYPOWER®. Choose your ultimate Gaming PC with tons of customizations to choose from, or pick a prebuilt gaming desktop! Explore top-rated custom gaming PCs and high-performance gaming computers at Digital Storm. Built with premium components for gamers seeking the ultimate. RTX 8GB GDDR6; 32GB DDR RAM; 1TB Solid State Drive; Microsoft Windows 11 Pro; 10// Network; ac Wireless; Bluetooth Infinity Gaming PC, CPU: Intel® Core™ Processor iK 6P/12 + 8E GHz [Turbo GHz] 24MB Cache LGA Buy Fortnite V-Bucks, the in-game currency that can be spent in Fortnite. You can purchase new customization items in the Shop for Fortnite Battle.

Gaming Apps To Make Money

Bubble Cash is the top classic bubble shooter game for your iPhone and iPad, giving you an exciting and rewarding experience. Sounds great right? Well, all you have to do is to download the BUFF app and let it run in the background and you will start earning BUFFs. Justice Poker and League11 are the best options for money-making game apps but it's important to approach money-making apps with a critical eye. You can earn money by doing simple things like playing games, watching ads, testing apps, giving your opinion on online surveys, and more! JumpTask works. Top free Apps like Tap Coin - Make money online for Android ; X World. · X-World: A Lifestyle App for Gaming, Entertainment, and Earning ; UGGAME- Thuê acc. GameChampions is the Authority on Sweepstakes & Social Casinos. Our Online Sweepstakes Gaming Platform makes it possible to Play Games and Earn Real Money with. Some of the best money-making games include Blackout Bingo, Dominoes Gold, Solitaire Cubes, Pool Payday, and Spades Cash. GAMEE PRIZES is an arcade filled with addictive, free-to-play (F2P) games designed to provide endless entertainment. InboxDollars is a money making app offering surveys, videos, and of course, games as ways to earn a few cents to a few bucks per hour, all on your own schedule. Bubble Cash is the top classic bubble shooter game for your iPhone and iPad, giving you an exciting and rewarding experience. Sounds great right? Well, all you have to do is to download the BUFF app and let it run in the background and you will start earning BUFFs. Justice Poker and League11 are the best options for money-making game apps but it's important to approach money-making apps with a critical eye. You can earn money by doing simple things like playing games, watching ads, testing apps, giving your opinion on online surveys, and more! JumpTask works. Top free Apps like Tap Coin - Make money online for Android ; X World. · X-World: A Lifestyle App for Gaming, Entertainment, and Earning ; UGGAME- Thuê acc. GameChampions is the Authority on Sweepstakes & Social Casinos. Our Online Sweepstakes Gaming Platform makes it possible to Play Games and Earn Real Money with. Some of the best money-making games include Blackout Bingo, Dominoes Gold, Solitaire Cubes, Pool Payday, and Spades Cash. GAMEE PRIZES is an arcade filled with addictive, free-to-play (F2P) games designed to provide endless entertainment. InboxDollars is a money making app offering surveys, videos, and of course, games as ways to earn a few cents to a few bucks per hour, all on your own schedule.

Play video games for money - Madden, FIFA, NBA2K, NHL, COD, Fortnite & more. Compete in online tournaments on XBox, PS5, Mobile & PC. Swagbucks is a website and app that lets you make money by playing games, answering paid surveys, watching videos and more. The more tasks you complete, the. Sponsorship is yet another method of making an earning from a mobile app. This model is usually incorporated with those applications that already have regular. If you plan to earn money by making an app or mobile game, here you can find insights into mobile app monetization. Onix-Systems is a mobile app development. Top 'get paid to play' apps & websites · Mistplay – Android only, huge range of games · JustPlay – Android only, fast payout but limited selection of games. Discover great casual games, collect loyalty points, give to charity and earn rewards. Ready to play? Download the app from GooglePlay to make money. Free apps make money. You could always use the freemium model, which is popular in startups and gaming apps. With this method, the free version of your app. Games commonly pay through bank transfers or payment services like Apple Pay and PayPal. If it's through the latter, make sure you already have an account set. Both free and paid apps contribute to the mobile gaming industry's revenue, with top-grossing apps earning hundreds of millions of dollars in revenue per year. We researched more than game apps to identify those that have good user ratings and provide clear information about what's required to win. WIN big time real cash rewards in real money games every week playing % FREE games on GAMEE Prizes. 70+ different minigames, we bring new ones every. AppStation is an Android app that lets you earn money every minute you spend playing games, taking surveys or referring friends. When you accumulate $5 in. On average, app earnings per download range between $ and $ Which Platform Should App Developers Use to Make More Money? Rewarded video ads. Popular among gaming apps, rewarded video ads help app makers earn money without annoying pop-ups or banners. Instead, these ads let users. Meet Buff, the ideal gamer's reward program. Game, earn Buffs, get Items, and Capture your Highlights. Welcome home, gamer. On average, app earnings per download range between $ and $ Which Platform Should App Developers Use to Make More Money? Look no further than Mistplay, the ultimate app for gamers seeking to earn rewards for their passion. With over 10 million downloads and an average rating of. The #1 loyalty program for mobile gamers. Discover games you'll love, and earn free gift cards for playing. Download Mistplay today! Check out this list of top gaming apps to earn money in India that can help you get a quick buck without breaking a sweat. Why Would Anyone Pay Me to Play Games? · Gaming companies or app developers partner with rewards sites, like Swagbucks, who have members who enjoy playing games.

Bank Of America Checking Account Requirements

Maintain a $5, combined average monthly balance in eligible linked business deposit accounts. · Use your Bank of America business debit card to make at least. Special offer. N/A · Monthly maintenance fee. $16 with options to waive · Minimum deposit to open. $ · Minimum balance. $5, to waive the monthly fee · Annual. account fees, including monthly maintenance fees for checking and savings accounts Maintain a minimum daily balance of $20, or more in your account. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or. You'll pay $12 per month to keep the account open, but you can avoid the fee if you meet any of the following criteria: you're a student younger than 24;. To open a Mountain America Credit Union checking account, you will need: Valid ID (driver's license, state ID or passport); Physical address and address. Maintain a $1, minimum daily balance · Have at least one eligible direct deposit of at least $ · Enroll in BofA's Preferred Rewards program. High minimum balance requirements for certain bonuses: Some Bank of America accounts require you to maintain an average daily balance of $5, or more for a. You can apply online for a checking account, savings account, CD or IRA. The minimum opening deposit for this account is $ Back to content. Mobile. Maintain a $5, combined average monthly balance in eligible linked business deposit accounts. · Use your Bank of America business debit card to make at least. Special offer. N/A · Monthly maintenance fee. $16 with options to waive · Minimum deposit to open. $ · Minimum balance. $5, to waive the monthly fee · Annual. account fees, including monthly maintenance fees for checking and savings accounts Maintain a minimum daily balance of $20, or more in your account. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or. You'll pay $12 per month to keep the account open, but you can avoid the fee if you meet any of the following criteria: you're a student younger than 24;. To open a Mountain America Credit Union checking account, you will need: Valid ID (driver's license, state ID or passport); Physical address and address. Maintain a $1, minimum daily balance · Have at least one eligible direct deposit of at least $ · Enroll in BofA's Preferred Rewards program. High minimum balance requirements for certain bonuses: Some Bank of America accounts require you to maintain an average daily balance of $5, or more for a. You can apply online for a checking account, savings account, CD or IRA. The minimum opening deposit for this account is $ Back to content. Mobile.

Checking Accounts · $ minimum to open · $ minimum daily balance or $ average daily balance for the statement cycle* · Interest Bearing Account. Your Social Security number. · A valid, government-issued photo ID like a driver's license, passport or state or military ID. · A minimum opening deposit of $ Bank of America requires a $25 minimum opening deposit for the most basic Bank of America checking account and $ for the other two tiers of checking. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or. Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. · You must be enrolled in Online Banking or. Minimum balances are $20, for the Gold tier, $50, for the Platinum tier, $, for the Platinum Honors tier and $1 million for the Diamond Tier. 5. Bank of America requires a $25 minimum opening deposit for the most basic Bank of America checking account and $ for the other two tiers of checking. The minimum required to open a savings account is $ A monthly maintenance fee of $8 is waived for six months for new accounts. Avoid the monthly fee if you. The standard program terms require an eligible Bank of America personal checking account and a qualifying balance of at least $20, for the Gold tier. At age 16, youth may open their own checking account with proper ID and review of the Greenpath CheckRight online course. Youth accounts require the physical. Learn more about bank account options for students, teens, and young adults. Review fees and requirements for opening a bank account at Bank of America. Transfers require enrollment in the service with a U.S. checking or savings account checking account to your Bank of America® savings account. We may cancel. Be a Preferred Rewards client (requires a minimum qualifying combined balance of $20, in a Bank of America® deposit and/or Merrill® investment accounts). The. Opening a free checking account is a great way to start your CommunityAmerica membership. It's quick and easy to fill out your application online. Or, if you. • Maintain a minimum daily balance of $1, or more in your account, OR accounts if you're about to overdraw your account. Please see the Personal. You can help avoid these fees by keeping a close eye both on your account balance and on the money you plan to spend. Some banks, including Bank of America. Low- or no minimum deposit requirement to open the account; No maintenance fees; Waived ATM fees for any transactions outside the bank's network; Free fraud. You'll pay $12 per month to keep the account open, but you can avoid the fee if you meet any of the following criteria: you're a student younger than 24;. Find information on rates and fees for your Bank of America accounts. Learn about monthly maintenance fees, ways to help avoid overdraft fees, and more. The only account on BofA's website that has a $25 monthly fee is the Advantage Relationship Banking. That account requires a minimum daily balance of 20k to.

Dividend Tax Brackets

Part-year residents are not subject to tax on dividend income received while a nonresident of Pennsylvania. Refer to Table – DIVIDEND INCOME – RESIDENTS AND. Additional-rate taxpayers pay %. If you're a Scottish taxpayer, although your Income Tax is based on the Scottish Income Tax Rates, you'll need to. However, "ordinary dividends" (or "nonqualified dividends") are taxed at your normal marginal tax rate. Subscribe to Kiplinger's Personal Finance. Be a smarter. If the result is zero or less, enter “0.” Utah has a single tax rate for all income levels, as follows: Date Range, Tax Rate. January 1, Lower Tax Rates: Qualified dividends are taxed at rates of 0%, 15%, or 20%, depending on the individual's taxable income and filing status. Beneficial for. Generally, if the foreign source income is taxed at the 28% rate, then you must multiply that foreign source income by and include only that amount in. The rates on qualified dividends range from 0 to %. The category of qualified dividend (as opposed to an ordinary dividend) was created in the Jobs and. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the different rates that apply during and to include the dividend tax break. Working out tax on dividends ; Basic rate, % ; Higher rate, % ; Additional rate, %. Part-year residents are not subject to tax on dividend income received while a nonresident of Pennsylvania. Refer to Table – DIVIDEND INCOME – RESIDENTS AND. Additional-rate taxpayers pay %. If you're a Scottish taxpayer, although your Income Tax is based on the Scottish Income Tax Rates, you'll need to. However, "ordinary dividends" (or "nonqualified dividends") are taxed at your normal marginal tax rate. Subscribe to Kiplinger's Personal Finance. Be a smarter. If the result is zero or less, enter “0.” Utah has a single tax rate for all income levels, as follows: Date Range, Tax Rate. January 1, Lower Tax Rates: Qualified dividends are taxed at rates of 0%, 15%, or 20%, depending on the individual's taxable income and filing status. Beneficial for. Generally, if the foreign source income is taxed at the 28% rate, then you must multiply that foreign source income by and include only that amount in. The rates on qualified dividends range from 0 to %. The category of qualified dividend (as opposed to an ordinary dividend) was created in the Jobs and. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the different rates that apply during and to include the dividend tax break. Working out tax on dividends ; Basic rate, % ; Higher rate, % ; Additional rate, %.

The 15% WHT rate applies on the gross payment on interest, royalties, and certain lease payments to related parties resident in low-tax jurisdictions. Oman . Dividends and interest income are taxed at a rate based on Connecticut Adjusted Gross Income. The rates vary from 1% to 14%. Connecticut Adjusted Gross Income. Understanding tax on dividends ; Higher Rate, £50,,, 40%, % ; Additional Rate, Over £,, 45%, %. A US corporation generally may deduct 50% of dividends received from other US corporations in determining taxable income. Under § 1(h)(11), qualified dividend income received by an individual, estate, or trust is subject to a maximum tax rate of 15 percent. Section (b)(1)(C). Qualified dividends are generally taxed at the long-term capital gains rate and not considered investment income unless the taxpayer makes a special election. No, the 0% rate applies only to the amount of long-term capital gain and qualified dividend income needed to bring your taxable income (including these items). A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that. qualified dividend income (as defined in paragraph (11)). (4) percent rate gainFor purposes of this subsection, the term “percent rate. Although qualified dividends are taxed at long-term capital gains rates under current tax law, you cannot use capital losses to directly offset qualified. Most income is taxed using these seven tax brackets, except for certain capital gains and dividends. Need help determining this number? Find out how to. The qualified dividend tax rate for is 0% for individuals making $ or less. Higher tax brackets will pay 15% or 20%. Learn about qualified. The amount of the excessive salary not reported as dividend income for federal income tax purposes should be reported as dividend income on Line 7 of PA The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. Qualified dividends are taxed at lower capital gains tax rates. If you receive them, they should appear in box 1b of your DIV. Interest income. If the dividend is non-qualified, they face a 22% tax rate (using the marginal income tax bracket table above), resulting in a $22 tax obligation. Obviously. The table above shows the percentage of Vanguard funds' net income eligible for reduced tax rates as qualified dividend income (QDI). Tax Rate Schedules · For Tax Years , , and the North Carolina individual income tax rate is % (). · For Tax Years and , the North. What are dividend tax rates in /25 and how much is tax-free? · % for basic rate taxpayers · % for higher rate taxpayers · % for additional rate. The distortion is caused by endogenous variations in the marginal tax rates over the business cycle, and is absent if dividend taxes are proportional. We find.

Best Checking Accounts With Rewards

Prepayments, late payments, and payoffs not included. Loans must be in good standing (active, current, not delinquent). c. % cash back on all posted credit. Choose a checking account with reward points or % APY. Use our checking chooser and find the checking account option that works for you!title. Best checking account bonuses · Chase (Private Client): $3, bonus · Citibank: Up to $1, bonus · Huntington National Bank: Up to $ bonus · BMO: Up to. Compare Checking Accounts. Previous. Account description1. Best for2. Benefits Rich Rewards® Checking. Our interest-bearing checking account that comes with. Compare checking accounts. Soarion Credit Union offers checking accounts for your all your financial needs - today and in the future. This account is considered one of the best checking account rewards programs because you can earn cash back on every signature-based transaction and extra from. Rewards Checking from Axos is an interest bearing, high-yield checking account that allows you to build your own APY. Take control of your earnings today. Find the checking account that best fits your requirements. Take advantage of this bonus offer by completing three simple steps as a new personal checking. Best Checking Accounts ; Best Checking Accounts Overall. Primis Novus Checking. Prepayments, late payments, and payoffs not included. Loans must be in good standing (active, current, not delinquent). c. % cash back on all posted credit. Choose a checking account with reward points or % APY. Use our checking chooser and find the checking account option that works for you!title. Best checking account bonuses · Chase (Private Client): $3, bonus · Citibank: Up to $1, bonus · Huntington National Bank: Up to $ bonus · BMO: Up to. Compare Checking Accounts. Previous. Account description1. Best for2. Benefits Rich Rewards® Checking. Our interest-bearing checking account that comes with. Compare checking accounts. Soarion Credit Union offers checking accounts for your all your financial needs - today and in the future. This account is considered one of the best checking account rewards programs because you can earn cash back on every signature-based transaction and extra from. Rewards Checking from Axos is an interest bearing, high-yield checking account that allows you to build your own APY. Take control of your earnings today. Find the checking account that best fits your requirements. Take advantage of this bonus offer by completing three simple steps as a new personal checking. Best Checking Accounts ; Best Checking Accounts Overall. Primis Novus Checking.

Best if you keep a lower balance but make frequent purchases! · 4% cash back on debit card purchases · Unlimited ATM fee refunds, nationwide · Early Bird Direct. Let's compare checking accounts and help you figure out which may be right for you. Earn higher interest when you keep a higher balance in your Kasasa Cash. Want to earn a higher rate of interest OR cash back on your everyday checking account for doing what you're already doing? Get the best rewards with Rewards. With our Free Interest Rewards Checking Account you can earn % APY2 on balances up to $10,, plus earn % APY over $10, and receive up to $25 in. Open an Online Rewards Checking Account with American Express. Earn Rewards & High Interest with No Fees to Open. Open a Personal Checking Account Today. Rewards Checking is our high-interest checking account and earns % APY, and it's also a free checking account. Chase Total Checking: Best for Branch Access · CIT Bank eChecking Account: Best for Online Checking · Axos Bank Rewards Checking: Best for High Interest Rates. Comparing Average Yields · Reward Checking: % · Standard Checking: % ( bps lower) · Savings Accounts: % ( bps lower) · Money Market Accounts. Reward Yourself with R Best Checking Account! · Our highest interest-bearing personal checking account, R Best Checking, simplifies your personal finance with an. Open a Quontic cash rewards checking account online in under three minutes and earn % cash back each month on all qualifying debit card purchases. You'll get access to cash-back rewards, fee discounts, rate bonuses, and overdraft fee forgiveness. Apply in minutes. Open an account. Couple enjoying coffee at. We've come up with a short list of rewards checking accounts from the nation's best banks. Some of these accounts earned their place because they offered a. Compare checking accounts. Find the best account for you. Clear Access Banking. Everyday Checking. Monthly service fee $5. Avoid the $5 fee each fee period. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs. Consumers Credit Union has a Free Rewards Checking Account pays out one of the highest yields nationwide. Go to bcgamezerkal1.site to learn more! Which account is right for you? · Access Investment Checking · Access Rewards Checking · Access Freedom Checking · Safe Spending Account · Student Checking. Reward Yourself with R Best Checking Account! · Our highest interest-bearing personal checking account, R Best Checking, simplifies your personal finance with an. Free checking that earns your choice of cash rewards. Find an account Compare accounts Every month you qualify. Our Reward Checking account has no minimum balance or monthly fees, and rewards you with up to % APY when you meet our easy qualifications each billing. Choose the reward that's right for you; get cash back every month or earn premium interest on your account balance. Compare the benefits and get started with the.

Apr Annual Percentage Rate Definition

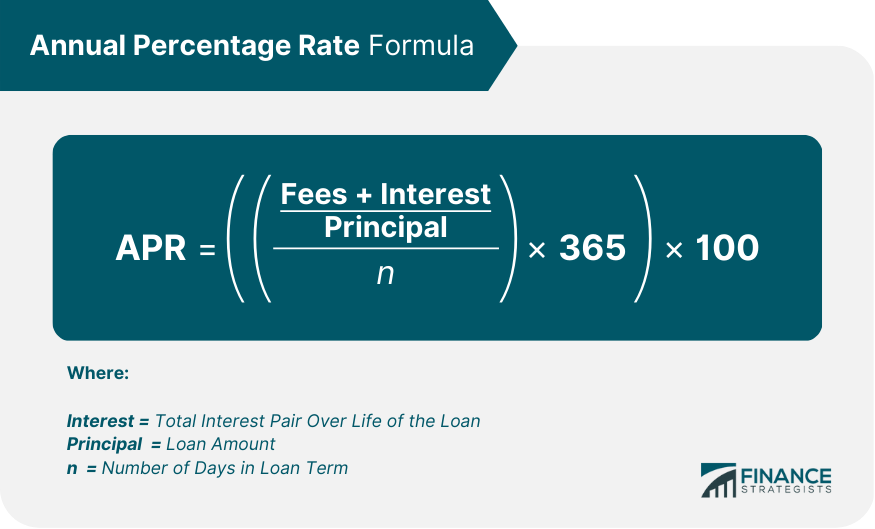

Key takeaways. Annual percentage rate (APR) refers to the yearly interest rate you'll pay if you carry a balance on your credit card. Annual Percentage Rate (APR) Definition A yearly interest rate that includes up-front fees and costs paid to acquire the loan, calculated by taking the. The interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card. annual percentage rate (APR) - A yearly interest rate that takes into account any fees or additional costs associated with obtaining a loan. The most common and comparable interest rate is the APR (annual percentage rate), also called nominal APR, an annualized rate which does not include. If you have a credit card, chances are you've seen the term annual percentage rate (APR), but you may wonder what that means. CNBC Select explains what APR. The APR is a measure of the interest rate plus the other fees charged with many types of loans, or the effective rate of interest. Both are expressed as a. The Annual Percentage Rate (APR) is the yearly rate of interest that an individual must pay on a loan or that they receive on a deposit account. The APR is the cost you pay each year for borrowing the money, including fees that you have to pay to get the loan, expressed as a percentage. Key takeaways. Annual percentage rate (APR) refers to the yearly interest rate you'll pay if you carry a balance on your credit card. Annual Percentage Rate (APR) Definition A yearly interest rate that includes up-front fees and costs paid to acquire the loan, calculated by taking the. The interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card. annual percentage rate (APR) - A yearly interest rate that takes into account any fees or additional costs associated with obtaining a loan. The most common and comparable interest rate is the APR (annual percentage rate), also called nominal APR, an annualized rate which does not include. If you have a credit card, chances are you've seen the term annual percentage rate (APR), but you may wonder what that means. CNBC Select explains what APR. The APR is a measure of the interest rate plus the other fees charged with many types of loans, or the effective rate of interest. Both are expressed as a. The Annual Percentage Rate (APR) is the yearly rate of interest that an individual must pay on a loan or that they receive on a deposit account. The APR is the cost you pay each year for borrowing the money, including fees that you have to pay to get the loan, expressed as a percentage.

Annual percentage rate (APR) is the annual cost of borrowing money, including fees A rate that isn't variable – meaning that it won't increase or. Annual Percentage Rate (APR) Definition A yearly interest rate that includes up-front fees and costs paid to acquire the loan, calculated by taking the. APR is a percentage that represents the actual yearly cost of funds over the term of a loan or income earned on an investment. What is APR? Annual percentage rate, also known as APR, is the cost of credit on a yearly basis, expressed as a percentage. An annual percentage rate (APR) is the yearly rate charged for a loan or earned by an investment. In other words, it is a measure of the cost of credit. The term annual percentage rate (APR), also called nominal APR, and the term effective APR, means the interest rate for a whole year, rather than just a. Annual Percentage Rate (APR) The interest rate is the cost you will pay each year to borrow the money, expressed as a percentage rate. APR is the annual cost of a loan to a borrower — including fees. Like an interest rate, the APR is expressed as a percentage. Unlike an interest rate. annual percentage rate (APR) - A yearly interest rate that takes into account any fees or additional costs associated with obtaining a loan. Annual percentage rate (APR) is the annual cost of borrowing money, including fees. Learn more about how to calculate it, different types of APR and more. An APR is a number that represents the total yearly cost of borrowing money, expressed as a percentage of the principal loan amount. A: The APR is the cost you pay each year for borrowing the money, including fees that you have to pay to get the loan, expressed as a percentage. Annual percentage rate · The APR is the cost to borrow money as a yearly percentage. · It's a more complete measure of a loan's cost than the interest rate alone. It includes interest as well as other charges. Because all lenders, by federal law, follow the same rules to ensure the accuracy of the annual percentage rate. APR stands for annual percentage rate and represents the full annual cost of borrowing money for a mortgage, including interest, various fees and points. APR. The meaning of ANNUAL PERCENTAGE RATE is a measure of the annual percentage cost of consumer credit (as in installment buying or a charge account) that is. The periodic rate times the number of periods in a year. For example, a % monthly rate has an APR of 18%. APR is an abbreviation of annual percentage rate, which is the annual rate of interest a bank or other creditor charges for lending money to a borrower. APR – or Annual Percentage Rate – refers to the total cost of your borrowing for a year. Importantly, it includes the standard fees and interest you'll have to. The annual percentage rate (APR) is a number that shows the total yearly cost of borrowing money and is expressed as a percentage of the loan amount itself.

What Are Current Fha Rates

The average APR on a year fixed-rate mortgage remained at % and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 1 basis point to %. First Home, First Generation & Salute ME Loan Rates ; First Home Loan 0 pts with Advantage. % · % ; First Home Loan 0 pts (no Advantage). % · %. Additionally, the current national average year fixed FHA mortgage rate remained stable at %. The current national average 5-year ARM FHA mortgage rate. Keep up to date on the latest housing industry trends with insights, analysis and news delivered to your inbox. Subscribe. What's on Your Mind? Send your. Mortgage Interest Rates ; Refinance Program ; Government Loans (FHA, VA, USDA-RD) Year Fixed Rate Loans ; Refinance Program, % ; Conventional Year Fixed. First-time homebuyer & FHA ; year FHA · % · % ; year FHA. % · %. What is the interest rate for a credit score on an FHA loan? Current FHA loan rates for a borrower with a credit score are around %. Rates change. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Today's Interest Rates ; CalHFA FHA · % ; CalPLUS FHA with 2% Zero Interest Program · % ; CalPLUS FHA with 3% Zero Interest Program · N/A ; CalHFA VA · %. The average APR on a year fixed-rate mortgage remained at % and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 1 basis point to %. First Home, First Generation & Salute ME Loan Rates ; First Home Loan 0 pts with Advantage. % · % ; First Home Loan 0 pts (no Advantage). % · %. Additionally, the current national average year fixed FHA mortgage rate remained stable at %. The current national average 5-year ARM FHA mortgage rate. Keep up to date on the latest housing industry trends with insights, analysis and news delivered to your inbox. Subscribe. What's on Your Mind? Send your. Mortgage Interest Rates ; Refinance Program ; Government Loans (FHA, VA, USDA-RD) Year Fixed Rate Loans ; Refinance Program, % ; Conventional Year Fixed. First-time homebuyer & FHA ; year FHA · % · % ; year FHA. % · %. What is the interest rate for a credit score on an FHA loan? Current FHA loan rates for a borrower with a credit score are around %. Rates change. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Today's Interest Rates ; CalHFA FHA · % ; CalPLUS FHA with 2% Zero Interest Program · % ; CalPLUS FHA with 3% Zero Interest Program · N/A ; CalHFA VA · %.

Today's FHA Mortgage Rates As of August 28, , the average FHA mortgage APR is %. Terms Explained.

The current FHA loan rate for a year fixed FHA purchase loan is %, based on an average of over FHA loan lenders, banks and credit unions. For. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. Government Insured FHA/VA/RD ; FirstHome, Program: FirstHome Rate: ; FirstHome Plus, Program: FirstHome Plus Rate: ; FirstHome w/ 2nd Loan, Program. Current Rates ; Loan Programs, 30 Year, 15 Year. First Home Limited & Veterans First Home Limited · ; Loan Amount, 30 Year, 15 Year. Taxable Loan · Check out current rates for a year FHA loan. These rates and APRs are current as of 08/27/ and may change at any time. They assume you have a FICO. Adjustable-Rate Payment Options: Lump Sum, Line of Credit, Term, Tenure, Combination. APR Illustration: % +% Monthly MIP = % in total interest. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Rates on FHA loans have moved around a lot in recent years — from less than 3 percent during the pandemic to 8 percent in October For most of early Mortgage Interest Rates ; Traditional First-Time Homebuyer Program · First-Time Homebuyer Program · %, % · % ; Next Home · Non-First-Time Homebuyer. Today. The average APR for the benchmark year fixed-rate mortgage fell to %. Last week. %. Today's Rate on a FHA Year Fixed Mortgage Is % and APR % With an FHA year fixed mortgage, you can purchase a home with a lower down payment. Today's FHA Loan Rates ; % · % · Year Fixed · %. FHA loans ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. %. %. $2, Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. The year fixed rate mortgage had an average price of %. The average FHA (b) loan was a tenth of a percent higher, at %. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Here are today's mortgage rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. FHA mortgage rates for today, August 27, ; year fixed FHA, %, %, + Today's current FHA loan mortgage rates. See your personalized rates for a FHA mortgage by providing answers to a few questions below.

Investing Money For The Future

Keeping pace with inflation: If you use your money today to buy what you need or want, this same amount of money in the future will usually buy less due to the. Explore your options or saving and investing toward your child's future education. Your money grows tax-free and can be withdrawn at any time without. Our five easy recommendations for getting started with saving and investing will set you on the right path. Once you've saved money for investing, consider carefully all your options well in the future, many investors choose to invest in mutual funds and ETFs. By investing early over time, your money grows in value, benefiting from the magic of compounding. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Keep cash for goals you want to achieve within the next two years in a low-risk account, such as a high-yield savings account that earns at least 3% interest. Free Money! Investing for Older Investors: Mutual Funds, Stocks and Bonds, Oh My! It's Tax Time: Getting a Tax Refund? Consider Investing It. Thinking of Day. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. Keeping pace with inflation: If you use your money today to buy what you need or want, this same amount of money in the future will usually buy less due to the. Explore your options or saving and investing toward your child's future education. Your money grows tax-free and can be withdrawn at any time without. Our five easy recommendations for getting started with saving and investing will set you on the right path. Once you've saved money for investing, consider carefully all your options well in the future, many investors choose to invest in mutual funds and ETFs. By investing early over time, your money grows in value, benefiting from the magic of compounding. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Keep cash for goals you want to achieve within the next two years in a low-risk account, such as a high-yield savings account that earns at least 3% interest. Free Money! Investing for Older Investors: Mutual Funds, Stocks and Bonds, Oh My! It's Tax Time: Getting a Tax Refund? Consider Investing It. Thinking of Day. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more.

Contributing more today to your retirement and/or brokerage accounts could jumpstart your plan for retirement. Still, there may not be extra money lying around. Exchange traded funds (ETFs), like mutual funds, are invested in stocks, bonds, money-market funds or other securities or assets, but investors don't own direct. All investments carry some level of investment risk – however, some investments have more risk than others. Generally, taking on this additional risk. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock. 1. Make a Budget · 2. Understand the Concept of Cash Flow · 3. Work With Your Partner · 4. Distinguish Between "Want" and "Need" · 5. Make It Automatic · 6. Do a. 1. Make a Budget · 2. Understand the Concept of Cash Flow · 3. Work With Your Partner · 4. Distinguish Between "Want" and "Need" · 5. Make It Automatic · 6. Do a. Investing is a huge part of building wealth, which is why Victoria's second book is all about learning how and why to invest, and taking confident action to. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. What I mean by that is start saving your money and then put it in a financial institution that offers what is called a money market savings. Investing puts your money to work to achieve your financial goals. One way is to earn interest on a sum of money you invest. Another way is to make a return. If you have a financial goal with a long time horizon, you are likely to make more money by carefully investing in asset categories with greater risk, like. One can invest in many types of endeavors (either directly or indirectly), such as using money to start a business or in assets such as real estate in hopes of. The bottom line is: invest early, invest regularly, be prepared for some risk and keep your money in your investment portfolio if the market dips. Whether you'. 7 steps to start saving money: A comprehensive guide to saving, budgeting, and investing for a better financial future. Investing lets you take money you're not spending and put it to work for you. Money you invest in stocks and bonds can help companies or governments grow, while. The longer you are invested, the more time there is for your investment returns to compound. Investing early can pay off over the long term. The "early". Investing is an effective way to put your money to work and potentially build wealth. Smart investing may allow your money to outpace inflation and increase in. Investing is one of the ways in which money can begin to work for you and offer an additional stream of income. Students are often times curious about investing. Your future self will thank you. What we cover: Borrowing Money; Planning a Budget; Investing; Renting vs. Buying a Home; Retirement A Youthful Profile. Investing can bring you many benefits, such as helping to give you more financial independence. As savings held in cash will tend to lose value because.

6 Month High Interest Savings Account

US$ Personal Account for Canadians · eAdvantage Savings Account — High Interest Savings · Bank accounts Regular interest: %5. Monthly fee6: $0. Minimum. CURRENT INTEREST RATES, ANNUAL PERCENTAGE YIELD (APY), MINIMUM DEPOSIT TO OPEN ACCOUNT, COMPOUNDED. Select 5-Month CD, %, %, $1,, Daily. 6-Month CD. Over 12 months through 24 months, the penalty is 6 months' interest, or; Over 24 months, the penalty is 12 months' interest. See the Consumer Account Fee and. A CD is a great savings tool for your long-term financial goals. When interest rates fluctuate, you can be confident that you have a guaranteed rate of return. High Yield CD Rates You Can Bank On. With terms ranging from 6 to 36 APY assumes interest earned remains on deposit until maturity. CD minimum. Lock in high interest rates. You get a fixed interest rate during the entire 6-month CD term. Your rate will typically be higher than a regular savings account. CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements. The High-Interest Savings Account · No monthly fee · % interest rate · 2 free monthly transactions · $5 per additional transaction · Sending an e-Transfer $ 12 The Annual Percentage Yields (APYs) and balances for an HSBC 6 Month CD account which are accurate as of 8/27/ are: % APY on balances of more than $0. US$ Personal Account for Canadians · eAdvantage Savings Account — High Interest Savings · Bank accounts Regular interest: %5. Monthly fee6: $0. Minimum. CURRENT INTEREST RATES, ANNUAL PERCENTAGE YIELD (APY), MINIMUM DEPOSIT TO OPEN ACCOUNT, COMPOUNDED. Select 5-Month CD, %, %, $1,, Daily. 6-Month CD. Over 12 months through 24 months, the penalty is 6 months' interest, or; Over 24 months, the penalty is 12 months' interest. See the Consumer Account Fee and. A CD is a great savings tool for your long-term financial goals. When interest rates fluctuate, you can be confident that you have a guaranteed rate of return. High Yield CD Rates You Can Bank On. With terms ranging from 6 to 36 APY assumes interest earned remains on deposit until maturity. CD minimum. Lock in high interest rates. You get a fixed interest rate during the entire 6-month CD term. Your rate will typically be higher than a regular savings account. CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements. The High-Interest Savings Account · No monthly fee · % interest rate · 2 free monthly transactions · $5 per additional transaction · Sending an e-Transfer $ 12 The Annual Percentage Yields (APYs) and balances for an HSBC 6 Month CD account which are accurate as of 8/27/ are: % APY on balances of more than $0.

Best 6-Month CD Rates · INOVA Federal Credit Union – % APY · DR Bank – % APY · Climate First Bank – % APY · My Banking Direct – % APY · AloStar –. A certificate of deposit typically earns higher interest than a traditional savings account account term (or the first 6 days following any partial. Contact Us ; Term (months). 3. Interest Rate. %. Annual Percentage Yield. % ; Term (months). 6. Interest Rate. %. Annual Percentage Yield. % ; Term. Explore high-interest Certificates of Deposit at SouthEast Bank. Secure your 6-Month CD Special, % APY*, Quarterly, $1,, Open Online. 9-Month. The best six-month certificate of deposit (CD) rate is currently % annual percentage yield (APY), while the national average rate is %. 3 month. Interest Rate %. APY %. Term 5 month (9). Interest Rate %. APY %. Term 6 month. Interest Rate %. APY %. Term 12 month. Interest. Below you will find rates for our most popular accounts that allow you to earn interest. ; 90 Day CD or IRA CD, $, % ; 6 Month CD or IRA CD, $ 6-Month GIC We do this by offering Members profit sharing, low borrowing rates, high interest savings accounts and great financial advice — that's the DUCA. No minimum balance · $0 minimum opening deposit · 6 available fixed terms (6 months to 60 months) · Interest paid monthly. Ready, set, grow · Terms options ranging from 3-Months to 5-Years · No minimum deposit requirement (with the exception of our Jumbo Certificates) · Federally. We generally recommend having an emergency savings of 3 to 6 months of your earnings. Jumpstart™ High Interest Savings. Earn more, save more. No monthly fee. Grow your money risk-free and earn interest every month. A HISA can help you 8 a.m. to 6 p.m. (ET) Friday, 8 a.m. to 5 p.m. (ET). Pictogramme. Compare various options of savings bank accounts to find best high interest saving account for you among all savings bank account interest rates. This special savings account pays you a higher interest rate in return for 6-Month Youth CD*. %. 6-Month CD. %. Month CD**. %. Month CD. Eagle High-Yield Savings Account*. $ - $,, $1,, %, 6 Months, $1,, %, %, Open An Account. 9 Months, $1,, Variable-rate sub-account interest is compounded monthly, not in advance. High-Interest Savings Account, %. Everyday Banking Account, 0%. Secured. The 6-month introductory interest rate of % (% Annual Percentage Yield [APY]) is available on new Market Monitor (money market) accounts opened between. High Yield Savings Account. Open now. $10, $10 - $9, %. $10, 6 Month CD, %, %, %. 8 Month CD. Open now. %, %, %. 9. Up to 6 transfers out each month and transfer amounts to savings apply Neither the Mileage Savings or Interest Savings accounts have monthly fees. With fixed interest rates and terms ranging from 6 months to 5 years, our CD accounts are a great way to save money you don't need right away.